april 2016 service tax rate

Upto 1 st June 2015. Rate of Service tax would eventually increases to 15 wef.

Long Term Capital Gain Tax Rate For 2018 19 Capital Gain Capital Gains Tax What Is Capital

Service tax will be replaced with GST from 1st July 2017.

. Service tax rate from 1st June 2016 is 15 with krishi kalyan cess. The standard Personal Allowance from 6 April 2020 to 5 April 2021 was 12500. Input Credit of Krishi Kalyan Cess paid on input.

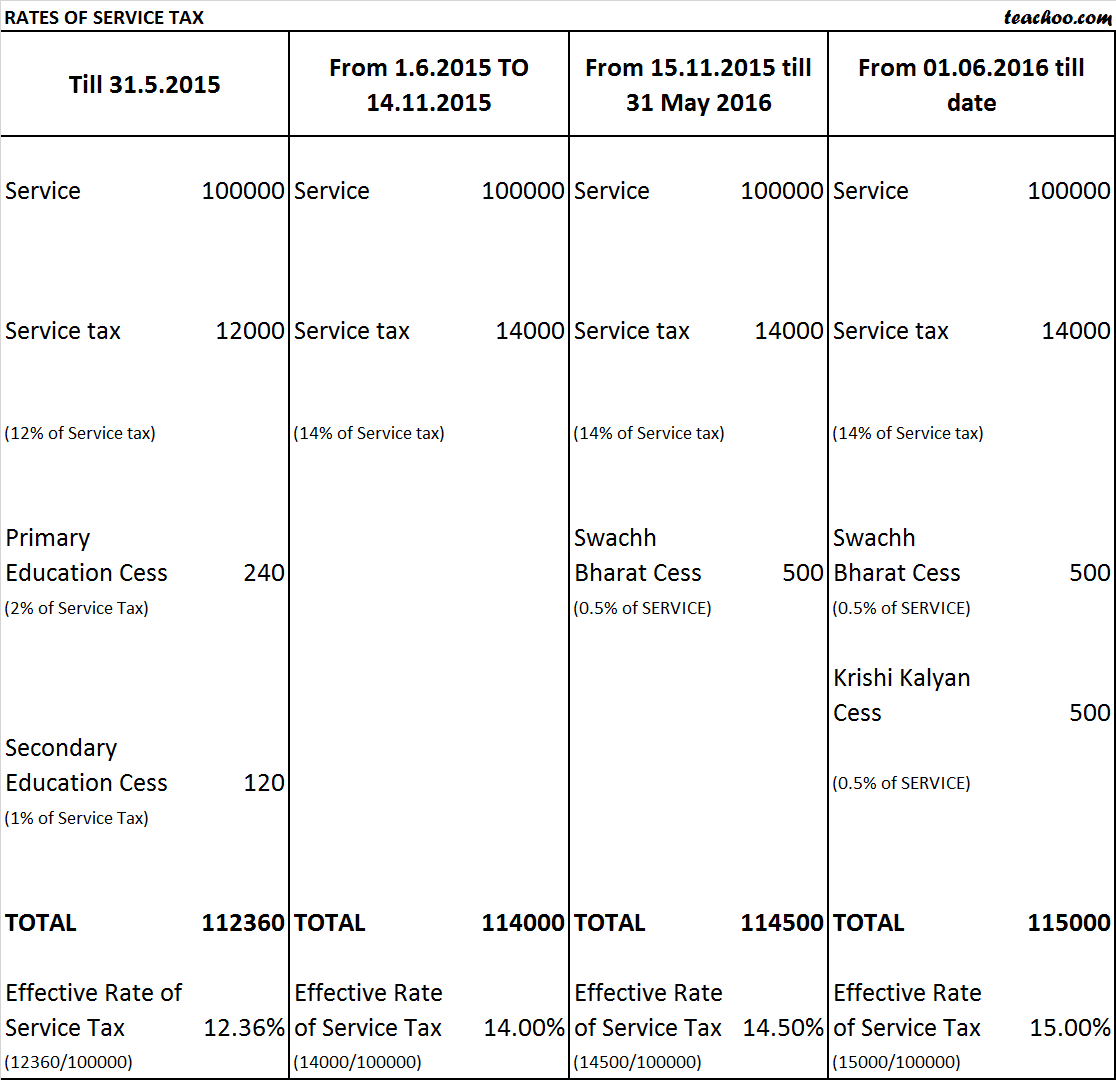

The service tax rate was increased from 1236 to 14 and the new rate subsumed a couple of cesses in the process. New Service Tax Rate effective from 01-06-2016. 50 lakh in the.

28 of 2016 the effective rate of Service Tax wef. In exercise of the powers conferred by section 109 of the Finance Act 2015 No. New Service Tax Chart with Service Tax Rate of 15 Service tax rate increased from 145 to 15 increase by way of levying Krishi Kalyan Cess at 05.

There is no direct change in service tax rate but With effect from 1 st June 2016 Krishi Kalyan Cess will be levied on any or all the taxable services at the rate of 05 on the value of such taxable services. The service tax rate changes for Promotion of Brand of Goods Services etc under Indian Budget 2017-18 is being updated below soon after announcement of Budget on 1 st February 2017. Service Tax Rate.

Consequently 1st April 2016 is being notified as the date from which the word support shall stand deleted from rule 21di E of Service Tax Rules 1994 so as to provide that the liability to pay service tax on any service provided by Government or local authorities to business entities shall also be on the service recipient on. New service tax rate chart for fy 2016-17 with service tax rate 15 from 1st june 2016 change in exemptions from service tax from 1st april 2016 change in abatement rate of service tax from 142016 Note 1 Rate of Service Tax is 14 Swacch Bharat Cess 05 Krishi Kalyan Cess is 05 2 Please note that SSI exemption of Rs10 lacs is. After enactment of the Finance Act 2016 No.

The government notification extract also is being updated in pdf format once after release from the authorities. Service tax rate increased from 145 to 15 increase by way of levying Krishi Kalyan Cess at 05. The Finance Bill 2015 proposes an increase in rate of Service Tax from 1236 to 14.

March 01 2016 has amended Service Tax Rules 1994 effective 1 st April 2016 as follows. 142015-ST dated May 19 2015 has notified increase in the rate of Service tax from 1236 to flat 14 Including Education Cess. I hope this article has updated you about service tax changes from 1st April 2016.

SERVICE TAX RATE CHART FOR FY 2016-17 and AY 2017-2018 upto 1st June 2016. The service tax rate under composition scheme for single premium annuity policies is being rationalized at the rate of 14 of the total premium charged. Service tax above certain threshold will also be required to file an annual return.

Swachh Bharat Cess 05 wef. From 15 November 2015 to 31 May 2016. These reports have caused wide spread confusion amongst all.

1 Rate of Service Tax. Rule 6 of the Service Tax Rules 1994 to be amended to extend the benefit of quarterly payment of service tax to One Person Company OPC whose aggregate value of services provided is up to Rs. News reports are being broadcasted and published stating that the rate has been increased from 01 st April 2015 are incorrect.

I have given here service tax rate chart for FY 2016-17 to describe rate on various services with abatement and reverse charge mechanism updated with budget 2016 changes. Finance Bill 2015 has proposed increase in rate of Service Tax from 1236 to 14. Important Changes in Service Tax in Budget 2015-2016.

NEW SERVICE TAX RATE CHART FOR FY 2016-17 with SERVICE TAX RATE 15 from 1st June 2016. 46 to 492016-ST all dated 9th November 2016 coming into force with effect from 1122016 Service tax would be charged on Online Information and Database Access or Retrieval OIDAR Services provided by any person located in non-taxable territory and received by a person located in taxable territory in India. A flat rate of 14 has been imposed which subsume all cess.

For the tax payers with value of taxable service less than 60 lakh rupees in PFY interest rate for delayed payment will be 12. From 1 June 2015 to 14 Nov 2015. CBEC vide Notification No.

In view of the Notification NO. Swatch Bharat Cess 05 of Value of Service has been imposed thereby effective ST rate 145. Till 31 May 2015.

Service Tax has been replaced by the Goods and Services Tax GST starting 1 July 2017. After levy of KKC Service tax rate would increase from 145 to 15 effective from June 1 2016. 20 of 2015 the Central Government hereby appoints the 1st day of April 2016 as the date on which the provisions of sub-section 1 of section 109 of the said Act shall come into effect.

Revised Service tax rate 14 applicable from June 1. From 1 st June 2015 14 th Nov. The Ministry of Finance increased the Service Tax rate in May 2015 and it was effective from June 2015.

Service Tax Rates have changed from time to time as shown below. Rate of Service Tax. The Said change will be effective from 1st June 2016.

After the Honble President has given assent to the Finance Bill 2015 on Thursday May 14 2015 the Ministry of Finance Department of Revenue vide Notification No. An illustration showing levy of Service tax and SB Cess KKC is given below assuming Rs. Section 67A provides that service tax rate shall be the rate on the date on which service was provided or agreed to be provided.

15 th Nov 2015 30 May 2016. The April 2016 dividend tax change first announced during the July Budget is expected to provide billions to help plug the hole in the public finances and will also fulfil another Government objective to remove some of the tax benefits of. The Said change will be effective from 1st June 2016.

Effective Rate of Service Tax. The Education Cess and Secondary and Higher Education Cess shall be subsumed in the revised rate of Service Tax. From 14th May 2016 date of applicability of finance Act 2016 the section is amended to obtain specific rule making powers in respect of Point of Taxation Rules 2011.

Concession of 3 will be available thus making the effective rates as 15 21 and 27 pa. Service tax rate hike from 145 to 15 due to Krishi Kalyan Cess-05 Levy. Taxable income above your Personal Allowance for 2020 to.

01-06-2016 is increased from 1450 to 15 14 ST 050 Swachh Bharat Cess 050 Krishi Kalyan Cess by way of introducing Krishi Kalyan Cess 050 on value of taxable services. 12 3 E SHE Cess 1236. Accordingly the rate of.

1000- as value of a taxable service.

Pin By Pooja Bhatt On Gst India Goods And Services Tax Goods And Services Goods And Service Tax Indirect Tax

Tax Day For 2016 Returns Is April 18 2017 Containing Hand 1040 Tax Form And In 2022 Tax Return Tax Day Income Tax Return

2016 Marketing Planning Calendar Vandenberg Web Creative Marketing Planning Calendar Marketing Strategy Social Media Marketing Plan

Income Tax Ppt Revised Income Income Tax Tax

Vani Holidays Provided Guaranteed Discount For International Packages You Join Vani Holidays Travel Company And Enjoy Dubai Holidays Dubai Travel Visit Dubai

Pin On Inventory Management Software India

What Is The Rate Of Service Tax For 2015 16 And 2016 17

One Nation One Tax Key Benefits Of Goods And Services Tax Gst Bill Goods And Services Goods And Service Tax Indirect Tax

Pin By Lisapetbulous On Electric Scooter Business Singapore Registration Number

1 Tds Rate Chart Fy 2019 20 Ay 2019 20 Notes To Tds Rate Chart Fy 2019 20 Ay 202 How To Find Out Job Posting Tax Deducted At Source

Ultimate 2017 Marketing Planning Calendar Vandenberg Web Creative Marketing Planning Calendar Marketing Plan Planning Calendar

Understanding Your Tax Forms 2016 1098 Mortgage Interest Statement Mortgage Interest Student Loan Interest Credit Card Services

Goldman Global Coordinated Easing Won T Last And The Fed Will Need To Hike Rates Four Times In 2016 Time Global Hiking

Do Shorter Hours Or Higher Wages Make Better Teachers Click Link To See The Interactive Details For Each Country Http Best Teacher Team Teaching Teachers

Income Tax Form Hmrc Why You Should Not Go To Income Tax Form Hmrc Tax Forms Income Tax Income

Tds Due Date List April 2020 Accounting Software Due Date Dating

Goods And Services Tax Economics Lessons Business And Economics Economics

Levy And Exemptions From Tax Under Gst Gst India Goods And Services Tax In India Goods And Service Tax Tax Goods And Services